Corey Nichols, Operation CLOVE, Auto & General Insurance

1. Overview of the Investigation:

Operation Clove was conducted by Auto & General Insurance and was a groundbreaking investigation that uncovered multiple claims involving a major insurance fraud ring. This operation demonstrated exceptional investigative acumen, cross-industry collaboration, and innovative techniques in combating insurance fraud.

2. Background and Context:

In 2023, a series of suspicious insurance claims were flagged by Auto & General. These claims prevented a combined settlement amount of $350K to the fraud network, with an ongoing recovery of one million dollars for historically paid claims that have confirmed involvement of this fraud network in staged auto accidents. The investigation began following an in-depth analysis that revealed a pattern suggesting a well-organized fraud network.

This specific case was notable for forensic accident reconstruction and voice recognition used to identify and link multiple claims that in combination created the entire operation. The investigation identified a network of individuals working together to stage accidents and file fraudulent claims. Auto & General discovered a spike in claims related to auto accidents with similar circumstances, repair company, hire car company, towing company, external assessors and voice recognition matches connecting multiple claims to this network which raised suspicion of fraud. The claims involved significant payouts for vehicle damage all following a consistent pattern suggestive of staging.

We identified that our insured client called and authorised members of the fraud network on their policy, identifying them as family members. This was to allow the particular member to speak on their behalf regarding the details of the incident and have a full understanding of the investigation in an attempt to control the claim outcome.

3. Objectives:

- To prevent further fraudulent activities and financial losses.

- To dismantle the network supporting the insurance fraud.

- To gather actionable intelligence for enhancing future fraud detection and prevention efforts.

4. Investigation Process:

The investigation was structured into several key phases:

- Initial Audit and Pattern Analysis: Comprehensive review of suspicious claims to identify commonalities and potential leads.

- Collaboration: Establishing an operation within our insurance company and collaborating with other insurance companies, and forensic accident reconstructionists.

- Data Analysis: Utilizing data analytics to detect anomalies, voice recognition of fraud network players, and linking the connection of insured and third parties to the fraud network.

- Interrogations and Follow-Up: Conduct thorough interrogations to uncover the full extent of the fraud and identify additional conspirators.

- Forensic Accident Reconstruction & Crash Data Retrieval: To provide evidence beyond reasonable doubt that these incidents did not occur in the way that was provided to us.

5. Key Investigative Techniques:

Factual Interview:

- The investigator appointed an external factual investigation company to conduct the factual interviewing face to face with the insured.

- The insured advised our factual investigator that on the date of the incident, this was a “normal day”, where he woke up and took his daughter to school and drove to work. There were no stops or detours taken between the insured’s daughters’ school and his destination (barber shop).

- The insured advised that this incident took place when leaving his workplace where the insured was turning right from his workplace car park onto David Street and did not see the truck (third party) coming from his left-hand side.

- The insured explained that when the truck hit the left-hand side of the insured vehicle, he was traveling approximately 10km/h prior, however, he had not crossed the line in the middle.

- The insured stated that when the third-party vehicle was about 5-10 metres away, he slammed on the brake, however, did not hear the brakes of the other vehicle and stated that “it happened so quick”.

- The insured recalled hearing the third-party horn, however, was too late to take any evasive action to avoid the collision. It was stated by the insured that at the time of the impact the insured vehicle was stationary, and his body moved to one side, however, couldn’t recall which way it was pushed.

- This information did not match up unless the truck was driving on the wrong side of the road when passing the client's workplace car park.

- In the re-enactment of the collision the insured explained that the third-party vehicle collided into the passenger side of the vehicle, impacting both front and rear passenger doors.

- The insured stated after the incident he felt dizzy therefore returned back to his workplace and told his colleague about the collision. The insured confirmed that he remained at his workplace until 5pm when his son arrived.

- The insured identified his son as a person which through voice recognition we had identified acting as the insured and third-party drivers on multiple claims.

- The insured confirmed that he remained at the shop until 6:40pm and during this time his son assisted with the lodgement of his insurance claim and received a haircut at the barber shop. After this the insured’s colleague dropped the insured to his residential address with the arrival time around 7pm.

- The insured advised that Ali was his son, however, was unable to provide the investigator with Ali’s contact number or his where abouts which confirmed our suspicion that Ali was not his son.

Forensic Accident Reconstruction & Crash Data Retrieval:

- The Insured vehicle displayed evidence of multiple impacts to the left-hand side panels.

- Vertical imprints, striations, and gouges are evidence of lateral impact while the Insured vehicle would have been stationary. If the Insured vehicle were moving at the time of these impacts, the marks would be horizontal.

- Overlapping marks confirm multiple impacts. With the vertical striations being over the top of the horizontal rub off marks, we can confirm the lateral impact occurred last.

- The left-hand side inner door sill was examined and found to have been deformed inward, with no evidence of longitudinal displacement. This confirms impact in a lateral direction.

- We found no evidence of the Insured Vehicle bowing, or of longitudinal displacement of the rear tray and canopy, however we found the rear tray and canopy were sitting off centre to the left by approximately 15mm. The tray was also found to be 30mm lower on the right-hand side than the left. We found no evidence of impact to cause this, and believe it is unrelated to the claimed event and likely pre-existing, due to OEM fitment or removal and fitment of the rear tray at some other point in time.

- We found no evidence of longitudinal panel displacement.

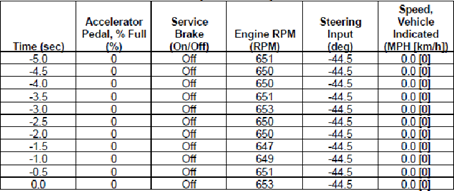

Pre-Crash data for the recorded event is listed in the Bosch CDR report in half second intervals, as shown below.

- This confirms the Insured vehicle was stationary, with the steering wheel turned at 44.5⁰ to the right. The foot brake was not depressed, the accelerator was not depressed, and the engine was idling at between 647 and 653 RPM. This information is not consistent with the Insured driving from the car park onto David Street as claimed.

- Crash Data acquired from the Insured Vehicle using the Bosch Crash Data Retrieval Tool has confirmed there was one deployment event which took place 83 ignition cycles prior to our download while the Insured Vehicle was stationary.

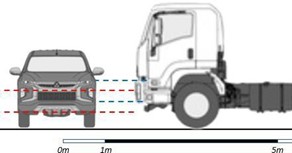

- Open-source data Isuzu FVM 1400 long vector drawing (the-blueprints.com) shows the width of the Third-Party vehicle to be approximately 2400mm. The image below uses scale diagrams of the Insured and Third-Party vehicles to show height comparisons between the two vehicles in a front view, and a view with the Third Party facing the left-hand side of the Insured vehicle.

- These views show some overlap of height profiles between the damage and the front bumper height on the Third-Party vehicle, however the top profile of the standard front bumper attached to the Third-Party vehicle sits slightly higher than the highest mark to the side of the Insured vehicle, and would have left marks above 900mm high, which were not present.

- Vehicle placement at the nominated area of impact together with the calculated PDOF has been considered. We found that the position of both vehicles at first contact, and maximum engagement, to be inconsistent with the claimed version of events that the Insured vehicle was turning right.

- The PDOF is consistent with the Insured Vehicle turning left, however the Bosch CDR data shows the steering wheel was turned 44.5⁰ to the right in the time leading up to the event and did not alter.

If we agree with the claimed version of events, which states the Third-Party Vehicle was travelling east on David Street and impacted with the left-hand side of the Insured Vehicle, then taking the PDOF into consideration, it shows the following possible scenarios:

- The Insured Vehicle was turning left, and not right as claimed.

- The Third-Party Vehicle was in the process of turning right into the car park at the same time the Insured Vehicle was leaving.

- If the Insured Vehicle were turning left and not right as claimed, the only two possible scenarios would be that either the Third-Party Vehicle was travelling east on the west bound lane of David Street, or the Insured Vehicle had crossed both west and east bound lanes and was turning left while on the northern grass verge or footpath. Evidence at the scene and information from the Insured does not suggest either of these scenarios as being correct.

6. Challenges and Obstacles:

The investigation encountered various challenges, including:

- Complexity of Fraud Schemes: Navigating through sophisticated and multi-layered fraud schemes designed to evade detection.

- Resource Constraints: Managing limited resources while covering a wide number of claims suggesting the fraud network was identifying as both insured clients and acting as third parties on other insured policies.

- Data Privacy Concerns: Balancing the need for comprehensive data analysis with the protection of personal data privacy.

7. Outcomes and Impact:

Operation clove achieved significant results, including:

- Organised Fraud Network: The investigation identified a network of individuals working together to stage accidents and file fraudulent claims. These individuals included drivers, passengers, and even some unscrupulous repair shop owners.

- Prevention of Further Fraud: The dismantling of this fraud network prevented future fraudulent activities, saving the insurance companies and their customers substantial amounts of money.

- Financial Recovery: Recovering one million dollars in fraudulent payouts and preventing future losses.

- Network Disruption: Dismantling the operational structure of the fraud network.

- Intelligence Changes: Influencing changes in our intelligence typologies to increase fraud detection and prevention.

8. Conclusion:

The successful investigation of this staged accident scheme underscores the importance of forensic accident reconstruction, crash data retrieval and voice recognition in uncovering complex fraud. The collaborative efforts of the investigating agency and insurance companies not only led to fraud detection and prevention in the industry.